As luxury markets adjust to global economic shifts, Rolex has unveiled its 2025 pricing strategy, revealing a stark contrast between steel and gold models. While stainless steel watches see only marginal increases, gold watches face dramatic hikes – a trend driven by soaring precious metal costs. Here’s a breakdown of what collectors and enthusiasts need to know.

Price Trends: Steel Stability vs. Gold Surges

Rolex’s 2025 pricing follows a clear pattern: stainless steel models remain nearly unchanged, with most rising by just €100 (1-1.5%). Platinum replica watches also see minimal adjustments (+1%), reflecting stable commodity prices. In contrast, gold dominates the increases:

Two-tone (Rolesor) models: +8%

Solid gold editions: +11%

This disparity stems from gold’s meteoric rise in 2024, climbing 27% annually (€60,618 to €80,641 per kilogram). Rolex has passed these costs to consumers, particularly impacting dress watches and sport models with gold components.

Stability Amid Uncertainty

After 2023’s inflationary spike (7-8% average price hikes), replica Rolex adopted modest increases in 2024 (+4%). Despite ongoing geopolitical tensions and China’s luxury market slump (26% drop in watch exports), 2025’s pricing reflects cautious optimism. Notably, gold’s volatility overshadows stable steel and platinum markets, shaping Rolex’s tiered approach.

Collection-by-Collection Breakdown

- Cosmograph Daytona

Steel (126500LN): +€400 (manageable 3-4%).

Gold models: +18.5% (€6,000-€8,000 leap), the steepest increase across all lines.

- Submariner & Submariner Date

Steel variants: +€100 (1%).

Rolesor: +€1,400.

Solid gold: +11% (€4,500+).

- GMT-Master II

Steel “Bruce Wayne” (126710GRNR) and classics like “Pepsi” rise marginally (+€100).

Gold and two-tone models surge +11% (€4,500-€4,700).

- Sea-Dweller & Deepsea

Steel models: +0.7%.

New full-gold Deepsea 136668LB debuts with an 11.4% premium.

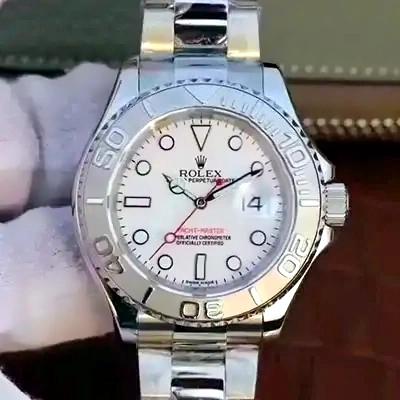

- Explorer & Yacht-Master

Explorer steel editions: +€100-150.

Yacht-Master II discontinued; titanium Yacht-Master 42 rises 5%.

- Sky-Dweller & Datejust

Steel Sky-Dwellers with gold bezels: +3%.

Datejust Rolesor models mirror gold’s +11% trend.

- Day-Date & Oyster Perpetual

Platinum Day-Date: +1%.

Gold Day-Date: +11% (€4,000+).

Oyster Perpetual: +1.6-2.6%, a relief after 2023’s 11% spike.

Notable Exceptions

Deepsea Challenge (titanium): +5%, aligning with Rolex’s niche titanium offerings.

Perpetual 1908 Platinum: +1% for the new blue guilloche dial, while gold variants jump 11%.

The Bigger Picture

Rolex’s pricing strategy underscores a broader luxury market reality: gold’s allure comes at a premium. While steel models remain accessible to entry-level collectors, gold’s volatility reshapes the brand’s high-end appeal. For investors, two-tone and solid gold pieces now demand deeper pockets – a trend unlikely to reverse as commodities fluctuate.

Whether you’re eyeing a timeless Submariner or a lavish Day-Date, 2025 marks a year where metal choice defines value more than ever.